Recently we have seen a major push by large corporations pushing WOKE propaganda and most often losing money, coining the term “Go Woke Go Broke”. The most famous campaign was the recent Bud Light Transgender campaign debacle that cost the company billions and its marketing manager her job.

Why is it that so many organizations are pushing this agenda of a tiny minority of the population all of a sudden?

It almost feels like it is coordinated right? Well it is. The video below explains what is happening.

Executives at companies like Nike, Anheuser-Busch and Kate Spade, whose brand endorsements have turned controversial trans influencer Dylan Mulvaney into today’s woke “It girl,” aren’t just virtue signaling.

They’re handing out lucrative deals to what were once considered fringe celebrities because they have to — or risk failing an all-important social credit score that could make or break their businesses.

At stake is their Corporate Equality Index — or CEI — score, which is overseen by the Human Rights Campaign, the largest LGBTQ+ political lobbying group in the world.

HRC, which has received millions from George Soros’ Open Society Foundation among others, issues report cards for America’s biggest corporations via the CEI: awarding or subtracting points for how well companies adhere to what HRC calls its “rating criteria.”

Businesses that attain the maximum 100 total points earn the coveted title “Best Place To Work For LGBTQ Equality.” Fifteen of the top 20 Fortune-ranked companies received 100% ratings last year, according to HRC data.

More than 840 US companies racked up high CEI scores, according to the latest report.

The HRC, which was formed in 1980 and started the CEI in 2002, is led by Kelley Robinson who was named as president in 2022 and worked as a political organizer for Barack Obama’s 2008 presidential campaign.

The HRC lists five major rating criteria, each with its own lengthy subsets, for companies to gain — or lose — CEI points.

The main categories are: “Workforce Protections,” “Inclusive Benefits,” “Supporting an Inclusive Culture,” “Corporate Social Responsibility and Responsible Citizenship.”

A company can lose CEI points if it doesn’t fulfill HRC’s demand for “integration of intersectionality in professional development, skills-based or other training” or if it doesn’t use a “supplier diversity program with demonstrated effort to include certified LGBTQ+ suppliers.”

James Lindsay, a political podcaster who runs a site called New Discourses, told The Post that the Human Rights campaign administers the CEI ranking “like an extortion racket, like the Mafia.

It doesn’t just sit back passively either. HRC sends representatives to corporations every year telling them what kind of stuff they have to make visible at the company. They give them a list of demands and if they don’t follow through there’s a threat that you won’t keep your CEI score.”

The CEI is a lesser-known part of the burgeoning ESG (Environmental, Social and Corporate Governance) “ethical investing” movement increasingly pushed by the country’s top three investment firms. ESG funds invest in companies that oppose fossil fuels, push for unionization, and stress racial and gender equity over merit in hiring and board selection.

As a result, some American CEOs are more concerned about pleasing BlackRock, Vanguard and State Street Bank — who are among the top shareholders of most American publicly-traded corporations (including Nike, Anheuser-Busch and Kate Spade) — than they are about irritating conservatives, numerous sources told The Post.

This week, Mulvaney’s new ad campaigns with Bud Light and Nike ruffled the feathers of critics from country star Travis Tritt and Kid Rock — who tweeted a video of himself shooting cases of Bud Light — to female Olympians and even Caitlyn Jenner, who said of Nike: “It is a shame to see such an iconic American company go so woke! … This is an outrage.”

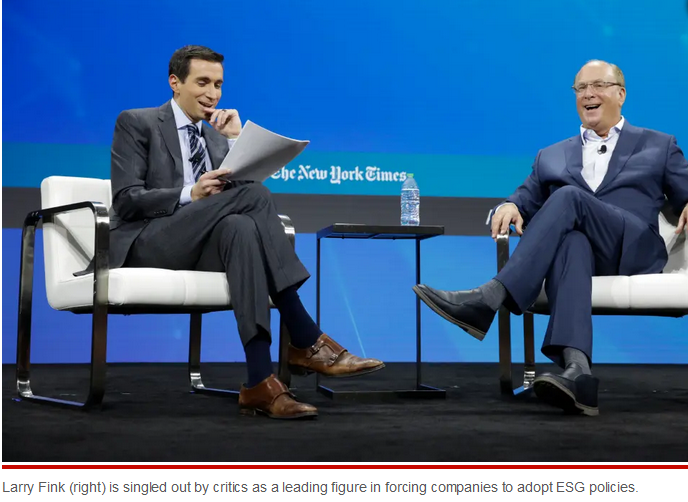

Assets manager BlackRock, along with Vanguard and State Street Bank are among the top shareholders of most American publicly-traded corporations (including Nike, Anheuser-Busch and Kate Spade) — and big supporters of ESG initiatives like the CEI. Black Rock CEO Larry Fink oversees assets worth $8.6 trillion and has been called the “face of ESG” which is the umbrella movement that includes CEI.

“The big fund managers like BlackRock all embrace this ESG orthodoxy in how they apply pressure to top corporate management teams and boards and they determine, in many cases, executive compensation and bonuses and who gets re-elected or re-appointed to boards,” entrepreneur Vivek Ramaswamy, who is running for president as a Republican and authored “Woke Inc.: Inside America’s Social Justice Scam,” told The Post. “They can make it very difficult for you if you don’t abide by their agendas.”

Source: https://nypost.com/2023/04/07/inside-the-woke-scoring-system-guiding-american-companies/

Woke, three-letter alphabet soup policies like ESG and CEI — which are supposedly based on “ethical investing” and are why major American corporations are handing out lucrative endorsements to fringe celebrities like transgender performer Dylan Mulvaney — sound wonky.

But one corporate analyst gave a succinct summation: “You can think about ESG as an attempt to sort of bring critical race theory to the private sector,” said Alison Taylor, executive director of ethical systems at New York University.

And like some universities and high schools where parents and administrators have fought back against critical race theory being embedded in the curriculum, America’s big corporations aren’t necessarily as eager to sign on to LGBTQ+, climate or anti-racist policies as you might think — despite the recent rash of endorsements by Nike, Bud Light and Kate Spade of transgender influencer Dylan Mulvaney.

The most controversial of those, by Bud Light, has wiped $5 billion off parent company Anheuser-Busch’s value since March 31, as it deals with the fallout from conservatives over its brand endorsement of the 26-year-old transgender TikTok and Instagram star.

The Post revealed Saturday how companies strive to receive a perfect “Corporate Equality Index” (CEI) score from the pro-LGBTQ+ lobbying group the Human Rights Campaign to comply with progressive policies espoused by the world’s biggest asset funds — pushing them into branding deals like the one with Mulvaney.

But American corporations are being strong-armed into policies that they don’t always agree with by influential nonprofit activist groups acting in concert with powerful fund managers, according to Republican presidential candidate Vivek Ramaswamy and other opponents.

They name BlackRock, Vanguard and State Street Corp., which each own up to 5 percent of most major US companies, as the ones doing the strong-arming, which Ramaswamy called “a protection racket.”

BlackRock CEO Larry Fink, among others, has been mentioned by ESG opponents as instrumental in the pressure campaigns, which they say are not in the interests of companies — or the pension fund members whose savings Fink and others invest.

The big asset companies like BlackRock, Vanguard and State Street Bank are shareholders of almost every Fortune 500 company and if they vote for a policy, CEOs who do not comply open themselves up to potential legal issues because it could look as if they are not acting in the best interest of shareholders, several anti-ESG analysts told The Post.

“It’s a protection racket,” Ramaswamy told The Post Wednesday. “If company executives don’t go along with it, they could see their compensation cut or their bonuses disappear and the chance of further investment from the big three funds could go away.”

When Ramaswamy was executive chairman of his “anti-woke” asset management firm Strive, he wrote letters to the boards of Apple and Chevron recommending that they decline to adopt ESG agendas which involved racial equity and climate policies. He called the agendas a “farce” and said they would not benefit shareholders.

Each company appeared to agree with Ramaswamy’s advice, he said — but then walked their plans back and ended up voting in favor of the ESG proposals under pressure from the activists who pushed them.

“The sequence of events about their boards agreeing but then reversing course was not in relation to my letters,” explained Ramaswamy, whose new book on the topic, “Capitalist Punishment: How Wall Street Is Using Your Money to Create a Country You Didn’t Vote For,” comes out April 25.

“It was in relation to the shareholder proposals put up by the nonprofit organizations. The boards initially opposed them, until BlackRock and State Street supported them and voted in favor of them, after which Apple and Chevron each shifted course.”

Disney too first balked at getting involved in the Gov. Ron DeSantis “Don’t Say Gay” controversy in Florida, but then went ahead and got on board to fight it.

Even worse, say Ramaswamy and other who oppose ESG, the fund managers who can influence how a corporate board votes are only proxy shareholders. They are using money from the pension funds of average Americans to jam through policy that the actual pension-holders might not even agree with — and which opponents say have been shown to lose money.

Source: https://nypost.com/2023/04/12/go-woke-or-lose-bonuses-ceos-forced-into-cei-system/

Pingback: What is the Mainstream media today and who owns it? - ROUTE 66 POST